PPC advertisers are stuck between rising costs and shrinking budgets. Every wasted click now feels like real money lost.

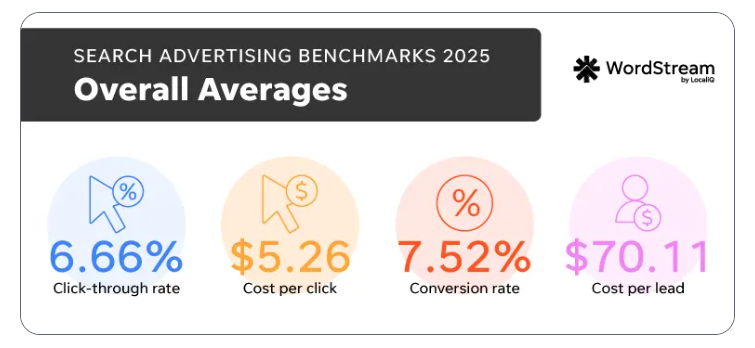

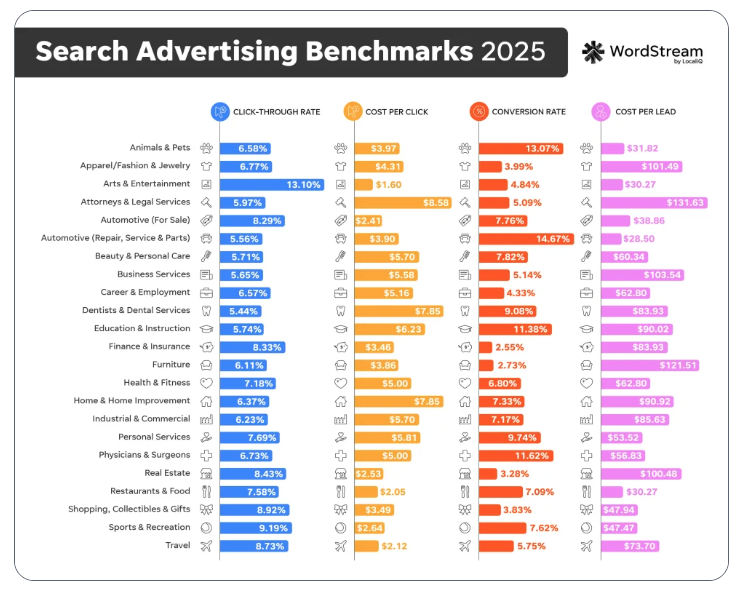

The average cost per click in Google Ads hit $5.26 in 2025—12.88% higher than last year. The three most expensive industries? Attorneys ($8.58 per click), dentists and home improvement companies (both $7.85). These high-stakes service industries face the steepest costs and the thinnest margins for error.

Here's the fragility: when clicks cost more, optimization mistakes compound faster. A campaign chasing lead volume instead of lead value bleeds budget at an accelerating rate. Wasted spend that used to be annoying becomes existential.

This article breaks down WordStream's latest Google Ads benchmarks and shows what rising costs actually mean for PPC advertisers who can't afford to guess anymore.

Note: Not a WhatConverts user yet? Start your free 14-day trial today or book a demo with a product expert to see how we help prove and grow your ROI.

The Fragility Problem: When Costs Rise, Waste Compounds

WordStream analyzed 16,446 campaigns from April 2024 through March 2025. The pattern is clear: search advertising costs have climbed year-over-year for five straight years.

But 2025 brought a shift. Cost per lead increased only 5.13%—a fraction of 2024's 25% jump. Conversion rates improved for 65% of industries.

Translation? Costs are rising, but performance is stabilizing. The agencies winning aren't the ones cutting harder. They're the ones optimizing smarter.

Here's the tension: when your average CPC was $4.22 and climbs to $5.26, that 24% increase hits every part of your funnel. If you're generating 1,000 clicks per month, you're now spending $1,040 more for the same volume.

That extra spend either comes from:

- Bigger budgets (unlikely in a tightening economy)

- Fewer clicks (which throttles lead generation)

- Better optimization (the only real option)

The problem compounds when you realize most advertisers still optimize for lead count, not lead value. At lower CPCs, that inefficiency was tolerable. At $5.26 per click, it's terminal.

Source: WordStream

What the Benchmarks Reveal About Industry Pressure

Some industries felt the squeeze harder than others.

Attorneys and Legal Services maintained the highest CPC at $8.58, but costs actually dropped 4.03% year-over-year while conversion rates climbed.

Dentists and Dental Services hit $7.85 CPC with a respectable 9.08% conversion rate.

Home and Home Improvement matched dentists at $7.85 CPC—but faced a tougher landscape. Conversion rates fell 14.97% year-over-year as economic uncertainty made homeowners hesitate on big projects.

Business Services saw CPC climb to $5.58 with cost per lead reaching $103.54. That's steep, but B2B deals often justify higher acquisition costs when a single client contract runs five or six figures.

Physicians and Surgeons fared a little better, posting an 11.62% conversion rate with CPC at $5.00 and cost per lead at $56.83.

Finance and Insurance kept CPC lower at $3.46, though conversion rates lagged at just 2.55%.

The pattern is clear: high-intent service industries can absorb rising costs when they optimize for lead value, not just volume. Real Estate, with its 8.43% CTR but only 3.28% conversion rate, shows what happens when clicks don't translate to qualified prospects.

Source: WordStream

Why Manual Optimization Isn't Enough Anymore

Five years ago, you could manually review campaigns weekly, trim underperformers, and maintain healthy ROI. That playbook doesn't scale when:

- CPCs rise 12.88% annually

- Ad platforms make thousands of bidding decisions per second

- Smart Bidding and Performance Max control where dollars flow

The algorithm only optimizes what you teach it to value.

Feed Google raw conversion counts, and it chases volume. A home services company running five campaigns at $15,000 total spend might see:

| Campaign | Conversions | CPC | Revenue | ROI |

| A | 87 | $40 | $0 | None |

| B | 34 | $82 | $67,000 | 24x |

| D | 19 | $158 | $94,000 | 31x |

Campaign A generates the most conversions at the lowest cost per click. It also generates zero revenue. Without lead values syncing back to Google, Smart Bidding keeps funding the wrong campaign.

That's the fragility: when costs rise and automation controls spend, your data quality determines whether you optimize or hemorrhage budget.

The Solution: Feed Platforms What "Valuable" Looks Like

Top-performing agencies automate their way through rising costs by teaching ad platforms what high-value leads actually are.

The repeatable system:

- Capture service intent on every lead (calls, forms, chats)

- Assign realistic values based on average sale or quote value

- Sync that data back to Google Ads in real time

- Let Smart Bidding prioritize profitable conversions

Collideascope, a full-service agency, automated lead qualification and value syncing through WhatConverts during an economic downturn. Results: 3x more qualified leads, 61% lower CPL, and an 8% decrease in monthly ad spend.

They didn't increase budget. They gave Google better information, faster.

When platforms receive lead values hundreds of times daily instead of weekly uploads, the algorithm identifies audience signals that predict high-value conversions and automatically shifts budget toward them.

Read More: How Collideascope 3Xed Qualified Leads and Cut CPL by 61% [Case Study]

Survival Requires Speed, Not Just Strategy

In a recession, optimization speed decides who stays and who gets cut.

Ad platforms make thousands of decisions per second. Your data has to move just as fast.

WordStream's Cliff Sizemore put it clearly:

"Costs are rising, but so is performance—65% of industries saw better conversion rates in 2025. The main takeaway here is that a smart strategy beats cheap clicks."

The agencies that automated lead qualification, value tracking, and real-time platform syncing didn't just survive rising costs. They used automation as a competitive advantage while manual competitors drowned in spreadsheets.

What This Means for Your Campaigns Right Now

If your cost per lead feels unsustainable, the benchmark data reveals where the pressure points are:

First, audit whether you're optimizing for volume or value. If Google only sees "conversion = yes/no," it's chasing the wrong goal at increasingly expensive CPCs.

Second, check if your conversion tracking assigns different values to different lead types. A $150 maintenance call isn't worth the same as an $8,000 system replacement. Treating them identically wastes budget on low-value volume.

Third, assess how quickly qualified lead data flows back to your ad platforms. Weekly uploads were fine when CPCs were stable. At $5.26 per click and climbing, that lag costs real money.

The math is simple: rising costs demand tighter optimization. Manual weekly reviews can't compete with algorithms making thousands of decisions per second—unless those algorithms receive accurate, real-time signals about what "valuable" actually means.

Ready to stop guessing which leads justify rising PPC costs?

Start your free 14-day trial of WhatConverts today or book a demo with a product expert to see how we help prove and grow your ROI.

Get a FREE presentation of WhatConverts

One of our marketing experts will give you a full presentation of how WhatConverts can help you grow your business.

Schedule a Demo

Grow your business with WhatConverts