Marketing generates leads. Sales closes customers. And in that gap, CAC spirals out of control.

Customer acquisition cost—total spend divided by customers won—determines whether your marketing earns trust or gets cut. But most marketers can't calculate it because they lose visibility after the lead converts.

Without that connection, you're optimizing for the wrong metric. And that's expensive.

This article shows how to track CAC accurately by connecting marketing spend to closed customers—so you can cut campaigns that waste budget and scale the ones that drive profitable growth.

Note: Not a WhatConverts user yet? Start your free 14-day trial today or book a demo with a product expert to see how we help prove and grow your ROI.

What Is Customer Acquisition Cost?

CAC is simple: all marketing and sales costs divided by the number of customers acquired.

Spend $10,000, acquire 50 customers = your CAC is $200.

But here's where it breaks. Most teams track cost per lead instead—because that's where their data ends.

Customer Acquisition Cost vs. Cost Per Lead

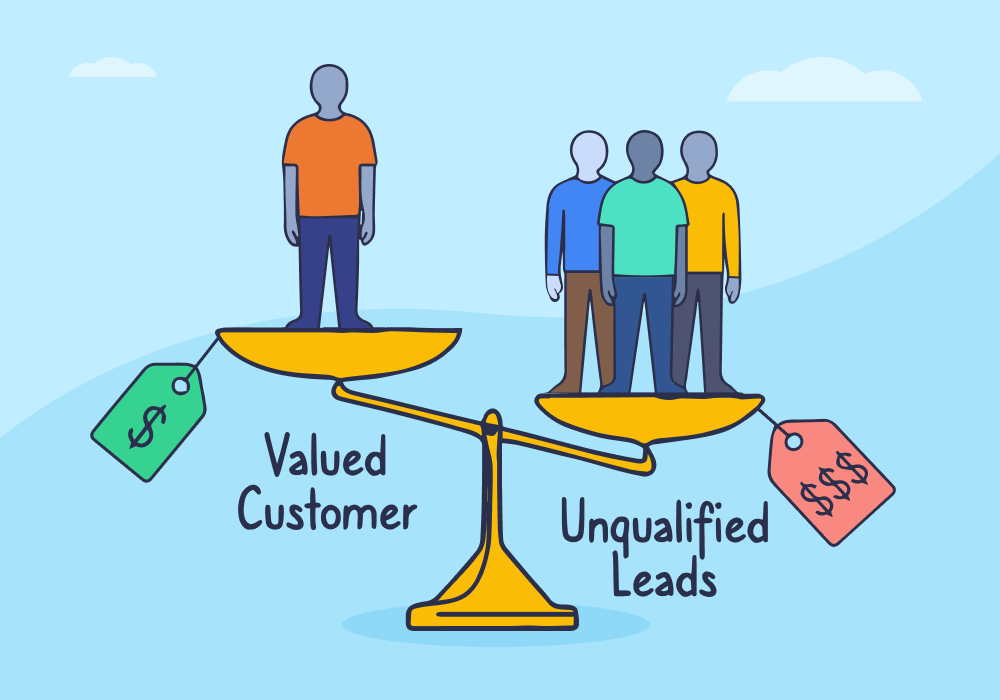

Cost per lead measures how much you spend to generate a conversion—a phone call, form submission, chat inquiry, or a quote request. CAC measures how much you spend to close a paying customer.

They're not the same number. And confusing them costs you.

A campaign with $75 CPL looks efficient. But if only 20% of those leads become customers, your real CAC is $375.

Meanwhile, a different campaign with $120 CPL might convert 50% of leads to customers—giving you a CAC of $240.

The "expensive" campaign with higher CPL actually delivers cheaper customers. Which means your "winning" campaign is actually bleeding budget.

How Marketers Can Lower Customer Acquisition Cost

Lowering CAC isn't about generating cheaper leads. It's about identifying which leads turn into customers—and funding those sources.

Here's what that looks like in practice:

An agency manages $20,000 in monthly ad spend across three channels. All three hit their CPL targets, so leadership assumes performance is solid across the board.

But when they connect leads to closed customers, a different picture emerges:

| Channel | Monthly Spend | Leads Generated | CPL | Customers Won | CAC | Customer Conversion Rate |

| Google Ads | $8,000 | 100 | $80 | 32 | $250 | 32% |

| Facebook Ads | $8,000 | 160 | $50 | 16 | $500 | 10% |

| LinkedIn Ads | $4,000 | 40 | $100 | 16 | $250 | 40% |

Facebook generates the cheapest leads—but the worst customers. Its CAC is double that of Google and LinkedIn.

By reallocating Facebook's budget to Google and LinkedIn (the channels with strong customer conversion rates), the agency maintains the same $20,000 spend but projects 64 customers instead of 48.

Same budget, 33% more customers, significantly lower blended CAC.

That's the power of optimizing for customer acquisition cost instead of cost per lead.

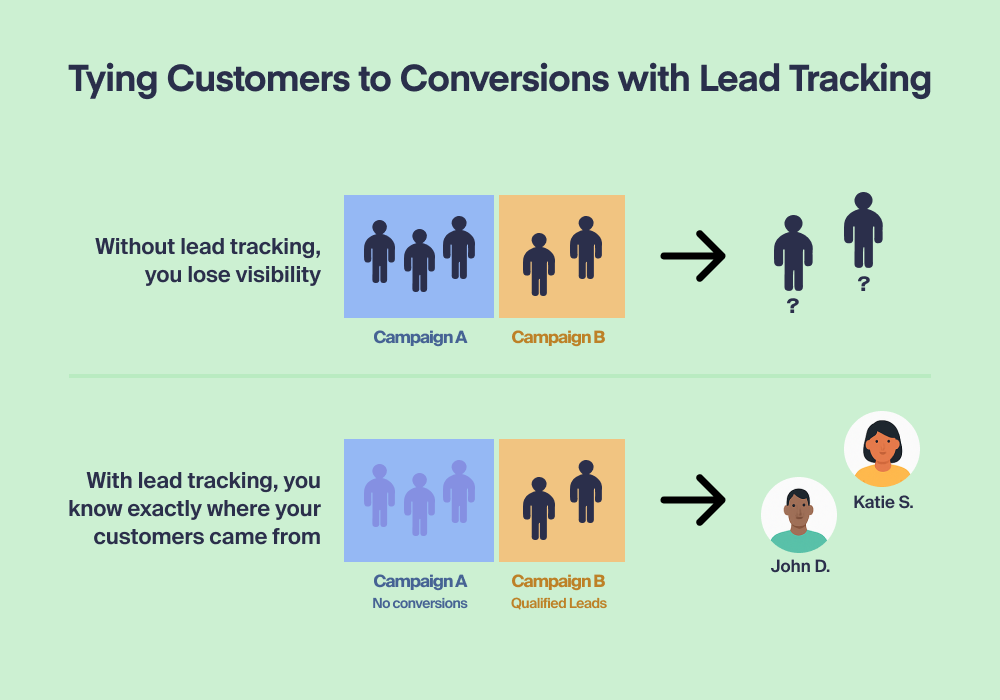

To do that, you need visibility connecting marketing campaigns to closed deals.

Most teams don't have it.

How to Tie Sales Outcomes to Marketing Campaigns

Native tools don't track this. Google Ads knows someone filled out a form. It doesn't know if that person signed a contract three weeks later.

The problem is the gap. Conversion data lives in Google Ads. Lead and revenue data lives in your CRM.

Nothing connects them.

To fix this, you need one unbroken line from initial click to closed customer.

Set Up First-Party Lead Tracking

Track every lead—calls, forms, chats, transactions—with attribution back to the exact marketing source that drove it.

This eliminates guesswork. You're not exporting spreadsheets and matching email addresses. You're capturing the source automatically at the moment of conversion.

Connect Your Lead Database to Your Sales Database

Either integrate your CRM directly or have sales manually update lead status in your tracking system when deals close.

Now you see which leads converted to customers and which ones died in the pipeline.

Send Qualified Leads Back to the Ad Platform

Push lead quality signals back to Google Ads and Meta. This trains the bidding algorithm to target keywords and audiences that produce customers, not just conversions.

Automation stops chasing cheap clicks. It starts hunting revenue.

Measure Campaigns by Sales Value

Stop reporting on conversion volume. Start reporting on closed revenue.

Campaign A generated 120 leads at $80 CPL. Campaign B generated 60 leads at $150 CPL. Campaign A looks better—until you see that Campaign B closed 18 customers while Campaign A closed 6.

Campaign B's CAC is less than a third of Campaign A's. And that's the number that matters.

Double Down on Revenue-Driving Marketing Efforts

Once you know which campaigns produce customers at the lowest CAC, reallocate budget toward them.

Cut the campaigns with great CPL but terrible CAC. Scale the ones producing paying customers efficiently.

That's how you lower CAC systematically.

The Systematic Solution

Lowering CAC requires closing the loop between marketing spend and customer revenue—automatically.

That's what WhatConverts does.

Unified lead tracking. Every call, form, chat, and transaction gets captured with full attribution to its marketing source. No manual exports, no data reconciliation.

CRM integration. Connect your CRM so lead status updates flow automatically. When a lead becomes an opportunity, then a customer, WhatConverts tracks it.

Revenue attribution. Assign sales values to closed deals. Now every campaign shows not just leads generated, but customers won and revenue produced.

Campaign-level CAC. See which campaigns produce expensive leads that convert into cheap customers—and which ones waste spend on leads that never close.

With complete visibility from first click to closed deal, you can optimize for what actually matters: cost per customer, not cost per lead.

Proof: Cutting CAC While Scaling Revenue

Repeat Digital manages paid campaigns for Navitas Safety, spending £35,000 monthly. Using WhatConverts to track every lead through to closed revenue, they discovered their real CAC and optimized accordingly.

The result: 28x ROI and the confidence to scale spend aggressively because they could prove which campaigns drove actual customers, not just form fills.

When you know your true CAC by campaign, optimization becomes surgical. Cut the high-CAC losers. Double down on the efficient winners.

Read More: Agency Untangles Attribution Knot, Scales Client to $1M

From Cost Per Lead to Cost Per Customer

Lowering CAC isn't about generating more leads. It's about generating better intelligence.

When you can trace every customer back to the marketing that brought them in, you stop optimizing for vanity metrics and start optimizing for revenue.

Here's the repeatable system:

- Track every lead with complete source attribution

- Connect lead data to your CRM

- Assign revenue values when deals close

- Calculate true CAC by campaign

- Reallocate budget toward campaigns with the lowest CAC and highest customer value

That's how top marketers prove ROI and earn bigger budgets—by showing leadership exactly how much it costs to acquire each customer and which campaigns deliver the best return.

Ready to stop guessing at your CAC and start optimizing for it?

Start your free 14-day trial of WhatConverts today or book a demo with a product expert to see how we help prove and grow your ROI.

Get a FREE presentation of WhatConverts

One of our marketing experts will give you a full presentation of how WhatConverts can help you grow your business.

Schedule a Demo

Grow your business with WhatConverts