Up to 80 % of new leads never turn into a single sale—a sobering figure that exposes the dark side of “more-is-better” lead generation programs. For many small businesses, piling on cheap contacts simply inflates workloads, drains budgets, and deflates sales teams once the promised pipeline fizzles out.

In this guide to evaluating lead generation companies for small businesses, we’ll show you how to break free from the volume trap. You’ll learn what truly drives revenue (lead quality, source transparency, ROI-aligned pricing, and responsive partnership) and how to spot red flags before they siphon your marketing spend.

Along the way, we’ll highlight real-world examples, data-backed criteria, and practical checklists you can use to benchmark providers. We’ll also show how tools like WhatConverts can be used to make working with a lead gen company a revenue-boosting success.

Ready to move beyond vanity metrics and choose a lead-gen partner that fills your sales funnel with customers, not just contacts? Let’s dig in.

The Volume Trap: Why “More Leads” ≠ More Customers

Up-front volume looks seductive, but research shows as many as 80 % of leads never make it past the first sales call (let alone close). When a lead generation company for small businesses promises scores of new contacts, remember that every one of those leads still consumes time, ad budget, and morale. If you’re not spending those resources on leads likely to convert, you’re hurting your bottom line.

Hidden costs that erode ROI:

- Extra sales hours spent chasing tire-kickers and wrong-fit prospects

- Lower close rates that drag down revenue forecasts

- Margin squeeze when reps feel pressured to discount just to move “dead” leads off their lists

The takeaway? Shift your primary KPI from cost-per-lead to cost-per-qualified-lead or customer. Until a prospect signs and revenue hits the ledger, lead count is just noise. Tools like WhatConverts bridge that gap by giving clear insight into which leads matter (i.e., are quotable) and which are burning budget.

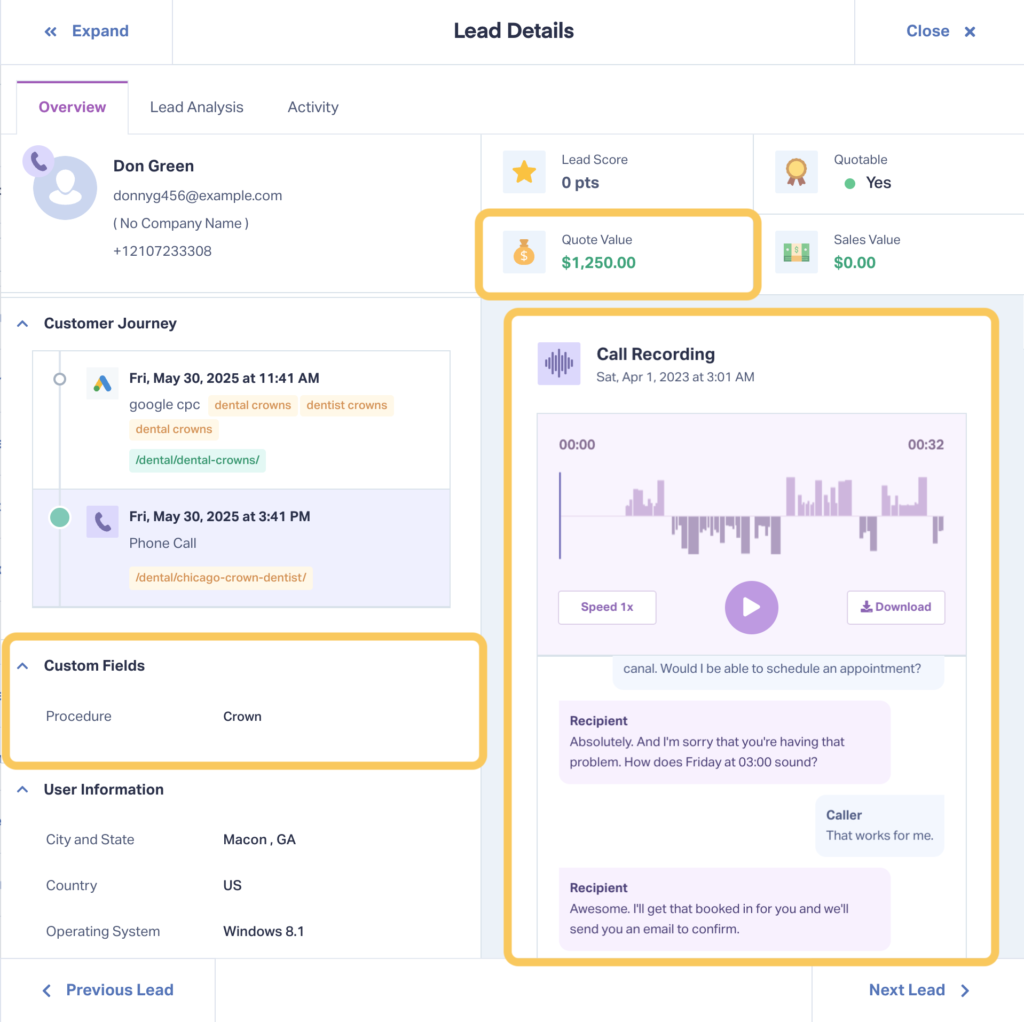

For example, you can see this call ended in a booked appointment worth $1,250.

Then, it ties those winning calls or form submissions back to the true source, revealing which campaigns create customers instead of clutter.

Five Non-Negotiables When You Size Up Lead-Gen Partners

Below are the five criteria that separate vendors who flood your inbox with tire-kickers from partners who reliably deliver paying customers. Treat them as a litmus test: if a provider can’t clear every bar, keep shopping.

1. Lead Quality Comes First

Shared marketplaces often blast the same enquiry to four or five businesses, forcing a frantic race to the phone. Contractors using services like HomeAdvisor (which is actually under investigation by the FTC) routinely report “commercial roofing” requests pushed to residential roofers or leads resold multiple times. The mismatch typically wastes money and morale.

Ask how the company verifies intent (phone validation, eligibility questions, spam filters) and whether the lead is exclusive or shared. A smaller, better-vetted flow of prospects will always beat a cheap torrent of junk.

Questions Worth Asking:

- How do you qualify a lead before I pay for it?

- How many buyers receive the same lead?

- What’s the refund policy for bad data?

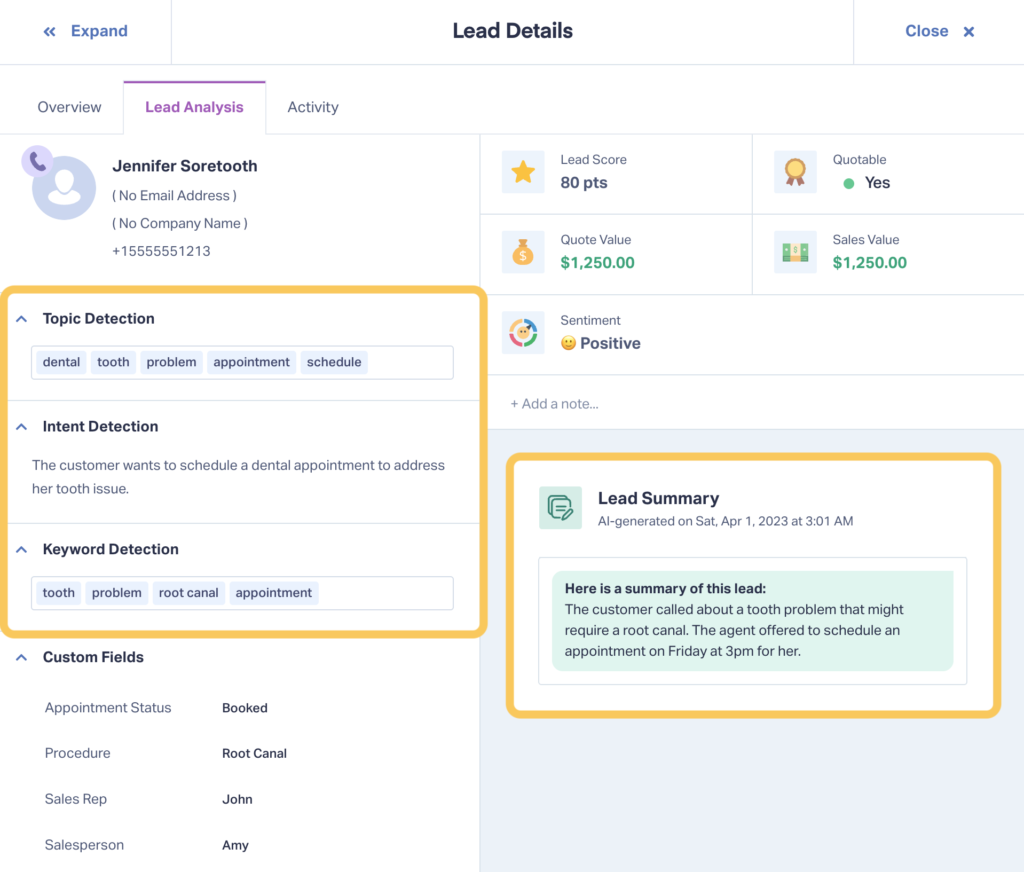

If you’re a WhatConverts user, you can quickly understand lead quality with Lead Analysis. This helpful tool uses AI to evaluate your calls and determine if a lead is valid (not spam), looking to buy, and even what services they’re interested in.

2. Radical Transparency in Sourcing and Reporting

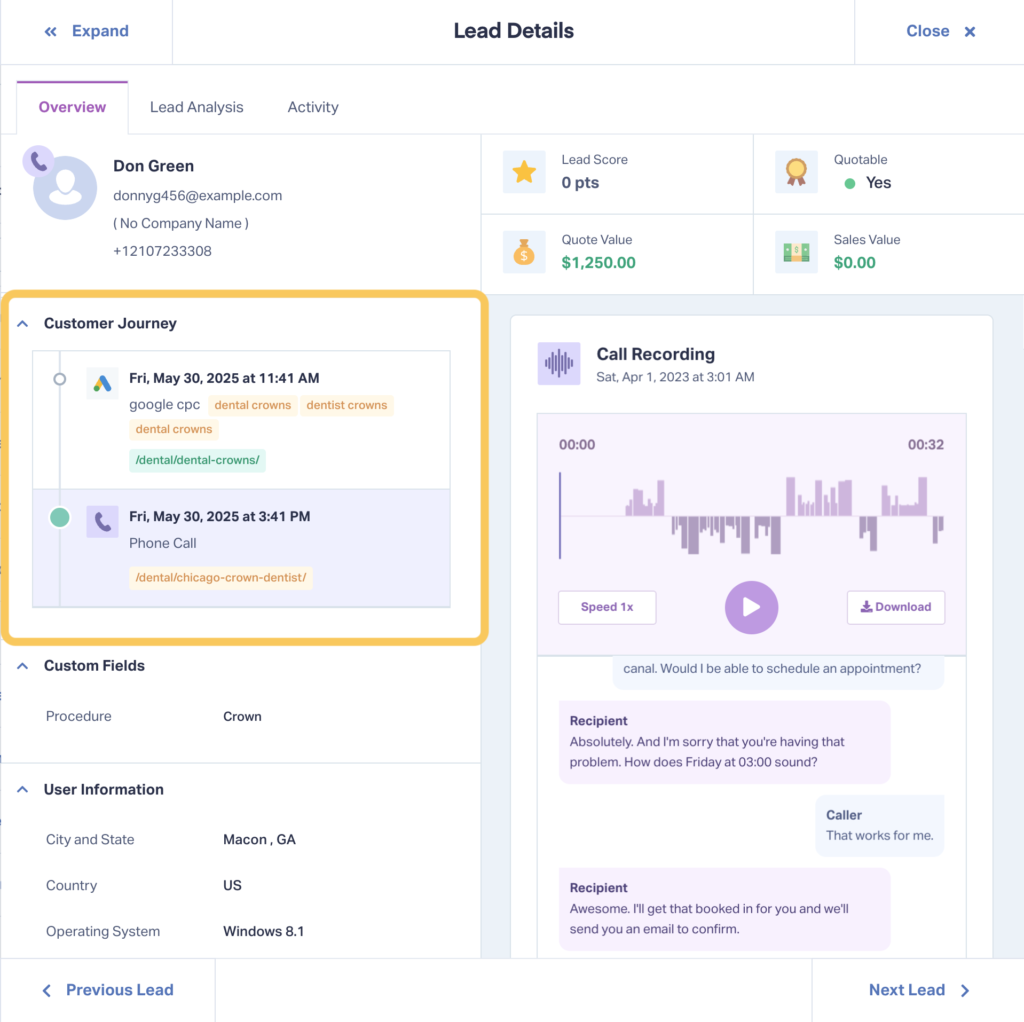

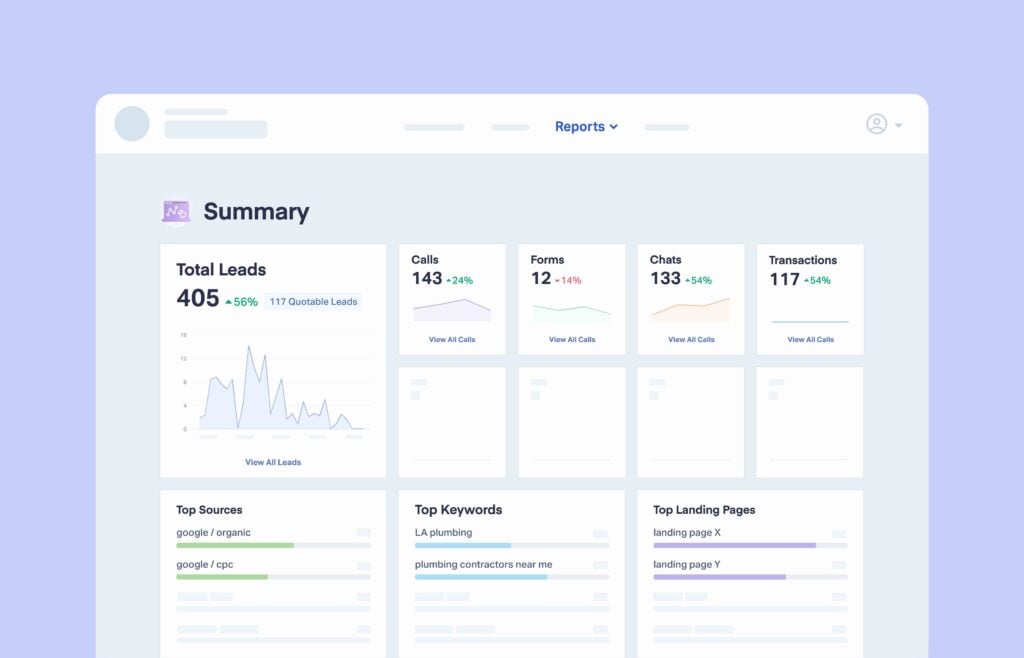

Any talk of “proprietary secret sauce” hides where traffic really comes from and why a spike in clicks may never translate to sales. A reputable partner hands you the raw data: UTMs or call-tracking numbers that flow straight into your attribution tool, plus a live dashboard you can check at any time, like the one below.

It should let you look into every lead, understand their quality, and see where they’re coming from. With that kind of visibility, you can cut spend on channels that attract noise and double down on the ones that create customers.

Questions Worth Asking:

- Which channels generate my leads, and can I verify that in real time?

- Will you supply UTMs or tracking numbers I own?

- How often will you review performance with me?

3. Pricing That Aligns with ROI, Not Vanity Volume

A flat retainer rewards the vendor even when leads flop, so look for pay-per-qualified-lead or tiered models that rise and fall with results. Top performers disclose every fee up front, and savvy marketers list hidden “technology” surcharges among the biggest deal-breakers. Before signing, run the math at your historic close rate to confirm the proposed cost per new customer actually pencils out.

Questions Worth Asking:

- What exactly counts as a billable lead?

- Are refunds automatic for wrong or duplicate leads?

- How will the total cost change as volume rises?

4. Responsive, Consultative Support

Slow, evasive emails during the sales courtship often foreshadow finger-pointing later. A provider that assigns a dedicated rep, documents reply-time SLAs, and schedules proactive optimisation calls signals they see themselves as an extension of your team, not a vending machine. Frequent, data-driven check-ins keep campaigns sharp and prevent small issues from snowballing into costly slumps.

Questions Worth Asking:

- Who will manage my account day to day?

- What’s your guaranteed response time for urgent issues?

- How often will you suggest campaign changes?

5. Demonstrated Expertise in Your Industry

Generic lead shops rarely grasp trade-specific buyer journeys or compliance quirks. Insist on case studies or references in your vertical; reluctance to share is telling, and recent FTC action against HomeAdvisor over quality claims shows reputation matters. Industry know-how lets a partner fine-tune targeting and messaging the moment regulations or market dynamics shift.

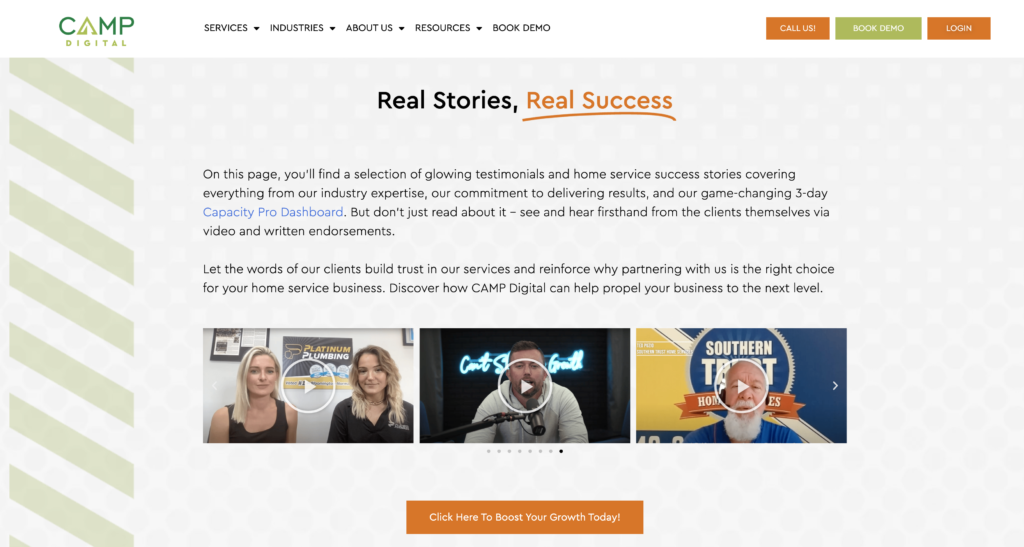

Look for providers with video testimonials from clients in your industry. CAMP Digital’s testimonials page is a perfect example of what to look for:

Questions Worth Asking:

- Do you have success stories in my niche?

- May I speak to two current clients?

- How do you adapt targeting and messaging for industry regulations?

Red Flags & Deal-Breakers to Spot Before You Sign

Even when a proposal looks polished, a few tell-tale signals can warn you that a “partner” is really a profit-at-all-costs vendor. Keep an eye out for the signs below; any one of them is reason to slow-roll negotiations or walk away.

- Guaranteed lead or conversion numbers without a quality plan. Promises like “10,000 leads a month—guaranteed!” sound enticing, but quality-first vendors know volume is unpredictable and conversion depends on your sales process. Empty guarantees usually mask low-intent traffic or shared leads.

- Opaque “proprietary methods.” If a provider won’t reveal which channels, keywords, or audiences drive your leads, assume the worst. Legitimate firms explain their mix (e.g., Google Ads, pay-per-call) and let you verify performance in real time.

- Long contracts with no performance out-clause. Multi-year agreements or hefty cancellation fees tie you to a partner even if ROI tanks. Best-in-class vendors offer short pilots or add clear termination language tied to cost-per-customer targets.

- Murky billing or a trail of refund disputes. Hidden “technology” fees, complex pricing tiers, or a pattern of complaints about bad-lead credits all point to revenue-first, customer-second behavior.

- Consistent negative reviews about lead quality. Scan industry forums and review sites like G2; repeated stories of mismatched or recycled leads often foreshadow the experience you’ll have.

Spotting even one of these red flags should prompt tougher questions or a pivot to a vendor that proves quality, transparency, and ROI before asking for your signature.

10-Step Evaluation Checklist (Swipe-and-Use)

Run every prospective partner through this quick litmus test before a single contract is signed. Copy it into your own scorecard, share it with the team, and check each box as you go.

- Define your acceptable cost-per-customer. Work backward from margin and lifetime value so you know the ceiling on acquisition spend.

- Pin down the close rate you need from purchased leads. If you close 1 in 5, the lead price must fit that math, or the deal won’t pencil out.

- Verify exactly how the vendor qualifies every lead. Ask for their phone-, email-, or intent-based checks and demand written criteria for refunds on junk leads.

- Demand channel-level attribution—UTMs, call-tracking numbers, the works. Real-time source data flowing into lead tracking tools like WhatConverts is non-negotiable.

- Confirm lead exclusivity (or the share count) before you buy. Shared marketplaces slash close rates and spark pricing wars; exclusivity protects ROI.

- Scrutinise contract length, cancellation terms, and performance outs. Long lock-ins with hefty fees trap you if lead quality tanks.

- Ask for industry-specific case studies and two live references. Proof beats promises; lack of vertical wins is a warning sign.

- Check that leads flow cleanly into your tech stack. API or native integrations close the loop from click to customer.

- Test responsiveness with a real inquiry before signing. Slow or vague replies now predict support headaches later.

- Schedule a 90-day ROI review with exit triggers in writing. Weekly lead-to-sale tracking during the first three months keeps everyone accountable.

Tick all ten boxes and you’ll walk into any negotiation knowing the vendor can (or can’t) deliver revenue, not just leads.

Measuring Success After You Hit “Go”

1. Pipe Every Lead into a Unified Tracking Layer

Feed each purchased call or form straight into a single platform like WhatConverts so every record carries its source, qualification status, and value. Vendors that assign unique phone numbers or UTM codes show confidence in their leads and give you independent data to verify quality. With that visibility, you can spot winning channels early and shut off the faucets that only pour in noise.

2. Run Weekly Lead-to-Sale Scorecards

For the first 90 days, pull a quick report every Friday that maps delivered leads → qualified opportunities, → closed customers. Tracking this funnel weekly surfaces pattern shifts before they drain budget, letting you tweak filters or landing pages while campaigns are still malleable. Share the same dashboard with your vendor so conversations stay objective and solutions-focused.

You can get easy access to your delivered leads → qualified opportunities right from your WhatConverts Lead Manager.

3. Hold a 90-day ROI Summit and Set the Next Targets

Block time at the end of month three to compare actual cost-per-customer against the ceiling you set in the evaluation checklist. If ROI lags, you either renegotiate scope, refine targeting, or walk away; if it meets or beats the goal, scale the highest-margin channels with confidence. Carry this cadence forward each quarter to keep both your team and your lead-gen partner accountable for real revenue, not vanity metrics.

Bottom line: Success isn’t how many leads hit your inbox—it’s how quickly those leads turn into profitable customers, and a tight tracking-plus-review loop is the fastest way to know.

Wrapping Up

The best lead generation companies for small businesses don’t hide behind big volume promises—they prove they can deliver customers through quality, transparency, and ROI alignment. Remember the sobering data point that as many as 80 % of bulk leads never convert—a reminder that cost-per-lead means nothing if those names don’t become revenue. Keep every vendor focused on that outcome, and you’ll avoid the “volume trap” for good.

Your three-part action plan

- Run the 10-step checklist on every proposal before you sign. It bakes in the five non-negotiables—from lead exclusivity to integration—and forces hard numbers on cost-per-customer.

- Track source → sale in real time. Pipe each purchased call or form into WhatConverts so you can watch qualified leads turn into closed deals and spot trouble early.

- Schedule a 90-day ROI review. Put a performance out-clause in writing, tie future spend to cost-per-customer targets, and renegotiate or walk if the math doesn’t work.

Ready to keep your lead generation company held accountable? Start your 14-day WhatConverts free trial today!

Get a FREE presentation of WhatConverts

One of our marketing experts will give you a full presentation of how WhatConverts can help you grow your business.

Schedule a Demo

Grow your business with WhatConverts