Most PPC marketers operate like fishermen with nets—cast wide, catch what you can, sort through the results later. Generate 1,000 clicks at $2 each, convert 50 into leads, close 5 into customers. The math works because you have abundant opportunities to find what works, then repeat it.

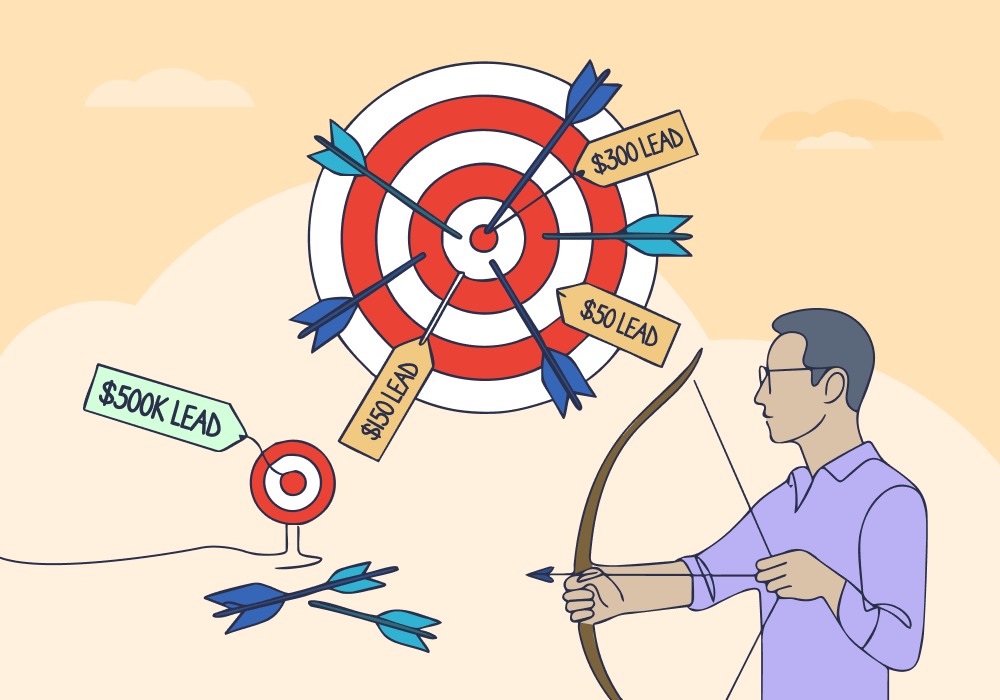

Mortgage marketing operates more like big game hunting. The housing market fluctuates dramatically—interest rates double, buyer activity plummets, entire demographic segments disappear overnight. Yet someone, somewhere, is always buying a house. Your job is to identify and target those individuals among millions of browsers who have no intention of taking action.

This creates a fundamentally different challenge. Instead of a wide target where hitting anywhere in the general area works, you're aiming for a much smaller bullseye. Miss with a $2 click, and you've lost $2. Miss with a $200 mortgage lead, and you've potentially blown your entire daily budget on someone who hung up the moment they heard current rates.

The difference between success and failure isn't just about hitting your target consistently—it's about hitting it accurately from the very first shot.

Read More: The Quantity → Quality Shift: Agency Boosts Quality Calls and Conversion Rates by 30%

Why Lead Tracking Becomes Critical for Expensive, Scarce Prospects

Traditional metrics catastrophically mislead mortgage marketers. Cost per lead becomes meaningless when most "leads" aren't qualified buyers. Conversion tracking fails when "conversions" include rate shoppers with zero intention of switching lenders. Without visibility into lead outcomes, you're essentially gambling with five-figure monthly budgets.

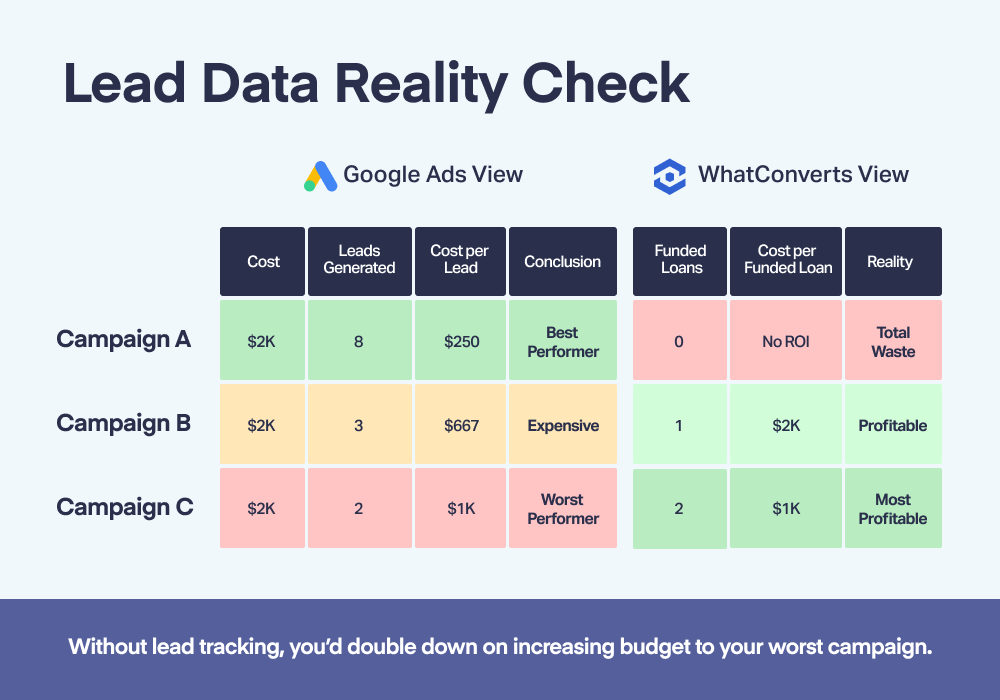

The $6,000 Reality Check

Let’s say you spent $6,000 across three campaigns last month and generated 13 leads total.

Here’s what the Google Ads data shows:

- Campaign A: Eight leads generated for $2,000 = $250 CPL

- Campaign B: Three leads generated for $2,000 = $667 CPL

- Campaign C: Two leads generated for $2,000 = $1,000 CPL

Based on this data, you would consider Campaign A your “best performer,” since it had the lowest cost per lead. Campaign B would be considered less successful, and Campaign C would be considered your “worst performer.”

Three of these leads wound up converting to borrowing customers, resulting in $3,000 in origination revenue each. But you have no idea which of these campaigns generated those specific, paying customers. That means you can’t make sure you’re not wasting budget on campaigns that don’t make money.

What WhatConverts Reveals

That’s where WhatConverts comes in. With comprehensive lead tracking, you can trace leads all the way back to their original conversion. So you can look at the three leads that turned into revenue and see which campaigns were responsible for them.

Here’s what the WhatConverts data shows:

- Campaign A: Eight leads at $250 per lead resulting in 0 borrowing customers = zero ROI

- Campaign B: Three leads at $667 per lead resulting in one customer and $3,000 in revenue = 1.5x ROI

- Campaign C: Two leads at $1,000 per lead resulting in two customers and $6,000 in revenue = 3x ROI

So the campaign that you thought was your “worst performer” actually had the highest campaign ROI, while your “best performer” was a giant waste of money with zero ROI. Without this data, you would double down on Campaign A, actively tanking your ad revenue.

The High-Stakes Targeting Problem

This scenario illustrates the main problem that mortgage marketers face: traditional strategies only work in industries where you can afford to fail before you succeed. These strategies ask you to spend money, learn from mistakes, and then optimize later and make up the lost budget on the back end.

But that approach doesn’t work in industries where leads can cost hundreds or even thousands of dollars each—and where, when the housing market dips, even those leads can be few and far between. Most mortgage marketers can’t afford to discover that a third of their marketing budget generated zero business value. You need a strategy that prevents expensive failures rather than planning to recover from them.

You need to be able to target with accuracy from the start.

Why Lead Tracking Is Essential for High-Stakes Marketers

Google Ads can tell you how many leads each campaign generated and how much each of those leads cost, but it can’t tell you that Campaign A’s leads were worthless rate shoppers who called around to many lenders and never submitted an application. It optimizes for activity metrics when you need to optimize based on outcome data.

Lead tracking makes this possible by attributing each and every lead to the specific source, medium, campaign, keyword, and ad that drove it. With this information, you can craft a strategy that doesn’t rely on expensive failures to learn how to target valuable leads.

What Changes When You Track Lead Outcomes

Lead tracking transforms marketing strategy because you can finally see what actually happened to your expensive leads:

You can measure what drives revenue instead of what drives activity. You optimize for cost per funded loan rather than lowest cost per lead. You measure qualified lead rates instead of celebrating generic conversion rates. This measurement shift reveals completely different campaign performance patterns.

You can stop wasteful campaigns before they burn your budget. You identify within 48 hours that Campaign A generated zero qualified leads and shift budget to profitable campaigns while they're still running, rather than waiting until month-end to discover the waste.

You can replicate what actually works instead of guessing. The two qualified leads from Campaigns B and C reveal specific audience characteristics and behaviors you can replicate, allowing you to target prospects who match successful patterns rather than casting wide nets and hoping.

You can optimize for Customer Lifetime Value (CLV) instead of origination revenue. Over time, as you continue to track the long-term outcomes to your original lead profiles, you'll be able to spot patterns not just in campaigns that generate real borrowers, but those that generate borrowers that stick around.

Reading the Warning Signs Before You Burn $2,000

When Campaign A started generating leads, the warning signs would have appeared immediately—but only if you had the data to see them. Any loan officer can tell when someone is rate shopping during the phone call. The problem is that, without lead tracking, you can't see that an entire campaign is generating nothing but rate shoppers.

Here's what those first three leads from Campaign A actually looked like:

- Lead #1 hung up within 20 seconds of hearing current rates.

- Lead #2 asked only about rates, provided minimal contact information, and never responded to follow-up calls.

- Lead #3 mentioned they were "shopping around" and asked for rate quotes without discussing timeline or loan programs.

Without attribution data connecting these leads back to Campaign A, your loan officers would have processed these as individual disappointing calls. But with lead tracking, the pattern becomes immediately visible: Campaign A is consistently generating the same type of unqualified prospect.

Contrast this with Campaign C's single lead: They asked specific questions about down payment requirements, inquired about FHA loan programs, mentioned a 3-month purchase timeline, and scheduled a follow-up consultation. The behavioral difference was stark—and immediately attributable to different targeting.

With proper lead tracking, you can identify these campaign-level patterns within the first week of launch. WhatConverts's Lead Manager shows you not just that leads came in and whether they were qualified, but exactly which campaign, keyword, and ad drove each lead. Campaign A's pattern of consistently delivering rate shoppers would have triggered an immediate campaign review.

Stopping the Bleeding While Your Budget Still Exists

Instead of waiting 30 days to discover Campaign A wasted $2,000, your lead tracking data reveals the need to pause the campaign after just $400, once the low-quality lead pattern becomes unmistakable. You can then redirect that remaining $1,600 to expand Campaign C, which is showing strong engagement signals. By month-end, instead of having one failed campaign and two modest successes, you have even more qualified leads from the expanded successful campaigns.

But that’s just the beginning. With enhanced conversions, you can send qualification data back to Google Ads as enhanced conversions. When Google's algorithm sees that Campaign A's leads consistently receive "unqualified" status while Campaign C's leads get marked as "qualified," it automatically reduces bidding on the keywords and audiences driving unqualified traffic.

This creates a feedback loop where your advertising platform learns to avoid the targeting characteristics that generated Campaign A's rate shoppers while increasing focus on the patterns that drove Campaign C's qualified prospects. Your campaigns get smarter with each qualified lead, rather than repeating the same expensive mistakes.

This is the difference between reactive and preventive marketing strategy. Traditional approaches force you to absorb expensive failures as "learning costs." Lead tracking lets you catch failures before they become expensive disasters.

Building a Marketing Strategy That Succeeds by Design

Mortgage marketing isn't about generating more leads—it's about generating the right leads without burning through your budget on expensive mistakes. The difference between Campaign A's disaster and Campaign C's success wasn't luck or market conditions. It was the ability to see what actually happened to each lead and make strategic decisions based on outcomes rather than assumptions. And that’s only possible with comprehensive lead tracking and optimization.

Ready to turn expensive mortgage leads into profitable growth? Start your 14-day free trial and discover which campaigns actually drive funded loans versus which ones are burning budget on rate shoppers.

Get a FREE presentation of WhatConverts

One of our marketing experts will give you a full presentation of how WhatConverts can help you grow your business.

Schedule a Demo

Grow your business with WhatConverts